Fundraising Insights from the Future Foundations for Giving Report

The recent Future Foundations for Giving Inquiry report marks a pivotal moment for philanthropy in Australia. Commissioned by the Productivity Commission and informed by an extensive consultation process, the report sets out a roadmap for ensuring that the benefits of giving can be fully realised in the years to come. As Australia aims to double philanthropic giving by 2030, the findings and recommendations of this report are timely and crucial.

Catherine Brooks (CEO, Wendy Brooks & Partners), in collaboration with LawSquared, presented on this topic in the first week of August.

If you missed it, you can still watch the full presentation online instead.

In this post, we’ll present you with our key takeaways and recommended next steps for charities, PAFs / PUAFs, and corporate foundations to adapt to the commission’s findings.

The Commission and the Inquiry

The inquiry was informed by an array of sources: 1,611 public submissions, over 120 consultations, roundtables, and days of public hearings. The Commission sought to capture diverse perspectives, including those of donors, charities, philanthropic foundations, researchers, and government bodies.

Their motivation for this was to analyse policy options that could support and expand philanthropy, determine how the government can incentivise donors, provide grants to charities, and maintain a regulatory framework that upholds public trust and confidence. This is important to keep in perspective when considering the major findings of the inquiry.

Why Philanthropy Matters

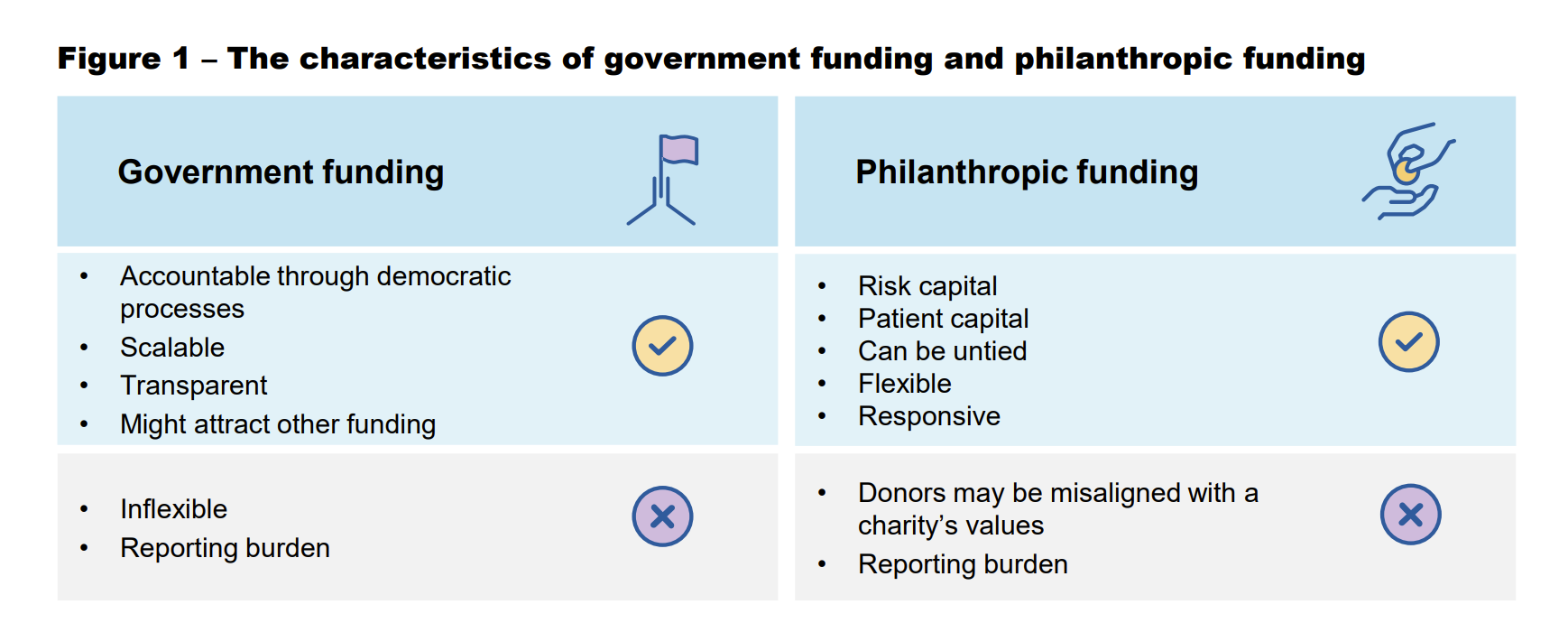

Philanthropy has the unique ability to fund innovative and riskier projects that government funding often cannot support. The report underscores that philanthropy can create benefits that the government alone cannot deliver as effectively or efficiently. Yet, the Commission found that current policy settings are not fit for purpose, necessitating reforms to build firmer foundations for philanthropy.

Issue 1: The DGR System Needs Reform

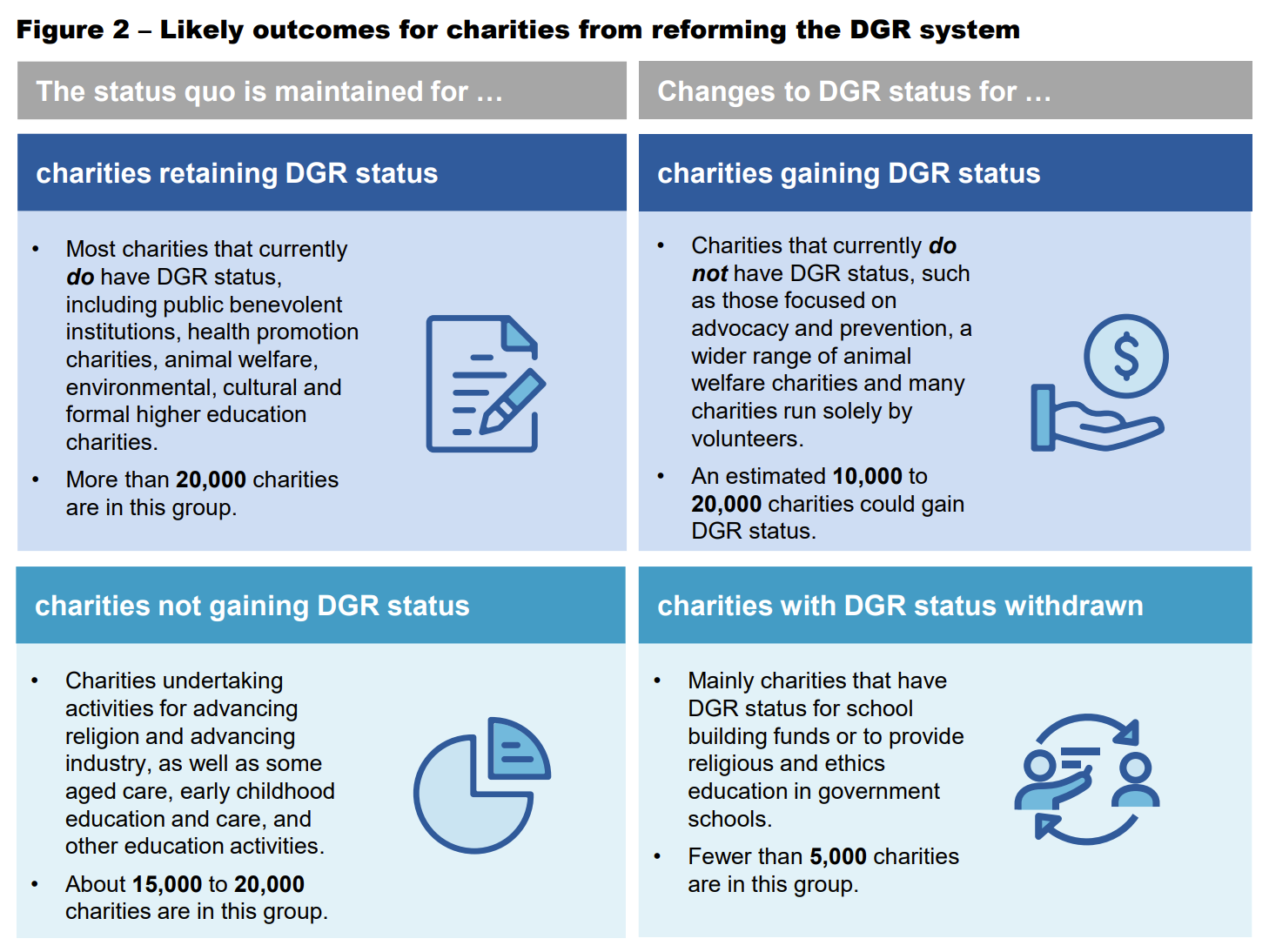

One of the most significant issues identified in the report is the outdated and overly complex Deductible Gift Recipient (DGR) system. Currently, the criteria determining which entities can access DGR status “lack coherent policy rationale.” The report recommends simplifying the system to ensure that support is directed where it can yield the greatest benefit. If these reforms are adopted, the number of charities able to access tax-deductible donations could grow significantly, expanding from 25,000 to as many as 40,000.

Issue 2: Strengthening ATSI Philanthropic Networks

The report also highlights the need for stronger relationships between Aboriginal and Torres Strait Islander (ATSI) organisations and philanthropic networks. The Commission recommends establishing an independent organisation, Indigenous Philanthropy Connections, led and controlled by ATSI people. This foundation would be funded by Government and facilitate new collaborations that support the ambitions of Indigenous Australian communities.

“The foundation would facilitate new collaborations between philanthropy and Aboriginal and Torres Strait Islander communities that support their ambitions.”

– Commissioner Julie Abramson, Productivity Commission

Issue 3: Enhancing the Regulatory Framework

Public trust in the charitable sector is vital. To enhance this, the Commission recommends reforms to the regulatory framework governing charities. This includes creating a National Charity Regulators Forum, which would formalise coordination and cooperation among national, state, and territory regulators. Additionally, the Australian Charities and Not-for-profits Commission (ACNC) would be granted increased information-gathering powers to ensure more effective oversight.

Issue 4: Improving Data Collection and Transparency

Transparency in corporate giving is another key area for improvement. The report recommends that the Australian government create more value from data collected about charities and giving, including by publishing aggregate information on corporate giving. Listed companies should also be more transparent about their charitable donations, reporting these as an item in their tax returns. This would allow for the regular publication of aggregated data on corporate giving, increasing accountability to shareholders, consumers, and the broader public.

Now is the time to prepare for change

The Federal Government is now considering the report’s recommendations, and the philanthropic sector must stay engaged to assist shaping the policy choices that follow. Organisations like Philanthropy Australia are already gearing up to work closely with the Government and sector partners to ensure that the proposed reforms are implemented effectively.

For those in the philanthropic and charity sector, now is the time to prepare. Whether you are a corporation, a private ancillary fund, or a charity, there are actionable steps you can take today to align with the report’s recommendations and strengthen your impact.

PAFs and PUAFs – develop a strategic giving plan

Private and Public Ancillary Funds play a critical role in the philanthropic ecosystem. The report recommends that these funds develop and maintain a distribution or giving strategy that outlines the causes you support, how you provide that support, and how you evaluate your effectiveness.

- Work with Wendy Brooks & Partners to develop a comprehensive distribution strategy. We can help you identify the causes you’re passionate about, choose the most effective ways to provide support, and establish metrics to evaluate your impact.

- By establishing a clear strategy now, you’ll be prepared to meet any future regulatory changes that may require more detailed reporting and accountability.

Charities – stay ahead of regulatory changes

Charities must stay informed about upcoming changes to the Annual Information Statement (AIS) that may arise from this report, such as the requirement to separately report income from bequests.

Additionally, the report highlights the potential for increased government funding to boost volunteering, which could significantly impact how your organisation operates.

- Wendy Brooks & Partners can help you navigate these changes by reviewing your reporting and assisting to make the most of new opportunities, such as increased funding for volunteering.

- If your charity relies on volunteers, look for our upcoming blog post on how to maximise government support and expand your volunteer base.

Overwhelmed by the inquiry? Don’t be

The philanthropic landscape is changing – for the better. If you need sector expertise and guidance to tackle the challenges and opportunities coming your way, then please reach out to Catherine on 0419 508 245 or by email at info@wendybrooks.com.au.